Ohio Mutual Can Help With All of Your Business Insurance Needs

Ohio Mutual protects your family by insuring your home against damage from fire, smoke, windstorms, and other catastrophic risks. And if you’ve got a number of valuable personal items that you keep on you property (like collectibles, jewelry, firearms, and artwork), we offer additional coverage to make sure you’re covered for their full value .

Every day, we continue to think of new ways to adapt our coverages and products to address new risks and concerns to modern homeowners. And that’s why we’ve added identity theft protection to our homeowners insurance repertoire, to help you feel the peace of mind you deserve.

We start by offering the following business insurance policies:

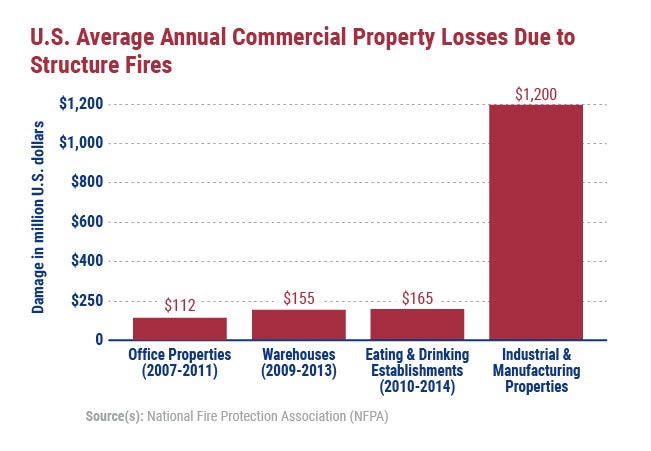

- Commercial property insurance

- Commercial liability insurance

- Inland marine insurance

- Commercial automobile insurance

Once your basic insurance needs are addressed, we’ll tailor your coverage specifically to the risks your business faces on a day-to-day basis.

We also offer insurance plans that let you combine several types of coverage into a simple package policy. These packages give you the customized coverage your business needs in a convenient package.

Customized coverage tailored to your business needs:

- Business package policy

- Business owners policy

- Artisan package policy

- Special multi-peril policy